CIET certification programs are recognized, prerequired or otherwise supported by many private and public organizations in Canada. They are frequently required as an essential requirement for job postings and are directly subsidized by several public utilities across Canada. In addition, most CIET training programs are eligible to many provincial assistance programs, which may be applicable to your personal situation and can help you achieve your training goals.

|

Canada Training CreditCIET offers a range of professional development courses that can provide individuals with the opportunity to enhance their skills and knowledge in energy efficiency. In addition, students enrolled in eligible courses may also be eligible for a tax refund under the Canada Training Credit. By taking advantage of this program, students can invest in their professional development while reducing their tax burden, and the only document needed to claim the refund is their course's invoice. For 2019 and subsequent taxation years, the budget proposes a new refundable tax credit called the Canada training credit available for eligible tuition and other fees paid for courses taken in 2020 and subsequent taxation years. The credit will be the lesser of the individual’s Canada training credit limit for the taxation year, and half of the eligible tuition and fees paid to an eligible educational institution in respect of the year. |

|

Training Grant Benefits |

|

Natural Resources Canada offers the Energy and GHG Management Training Program to federal employees as part of its Greening Government Support Services. If you want to know if you qualify for this incentive program, please send an email at: nrcan.greeninggovernment-gouvernementvert.rncan@canada.ca |

|

Canada-Alberta Job GrantThe Canada-Alberta Job Grant is a training program where an employer applies on behalf of their present or future employees for eligible training costs. Employers decide who gets training and what type of training may be needed for their employees. An employer is eligible to receive up to $10,000 in funding per trainee per fiscal year (April 1 to March 31). |

|

B.C. Employer Training Grant program (ETG)The B.C. Employer Training Grant program (ETG) supports skills training to address provincial labour market needs. The program is delivered by the Province of British Columbia and is funded by the Government of Canada through the Workforce Development Agreement (WDA). The goal of the ETG is to help British Columbians access the skills training needed to adapt to the changing requirements of jobs and the labour market while encouraging employer involvement in the training of their employees. |

|

Energy Managers Support ProgramThose involved with BC Hydro’s energy manager program should get in touch with their key account manager about eligibility for support from BC Hydro notably for the Certified Energy Manager (CEM) and the Certified RETScreen Expert (CRE) training programs. |

|

Labour Force TrainingThe program provides funding to eligible businesses and organizations to train individuals who are being considered for an available job in their company and/or to improve the skills and opportunities of their new or existing employees. |

|

Canada - Newfoundland and Labrador Job GrantThe Canada-Newfoundland and Labrador Job Grant (CNLJG) provides funding to eligible businesses and organizations to help offset the cost of training for their existing and future employees. The program provides up to a maximum of $10,000 per year towards training an existing employee and up to a maximum of $15,000 for training an unemployed participant. The employer contributes at least one-third to the cost of training, with the exception of an unemployed participant. The employer must have a job for all participants at the end of training. |

|

Canada - Northwest Territories Job GrantThe Canada Northwest Territories Job Grant is a cost-sharing program that helps employers offset the cost of training for new or current employees. The Grant helps Northerners gain the skills they need to fill available jobs; it helps employers invest in their workforces, equipping workers with the training necessary to make their businesses succeed. Employers can receive up to two-thirds of the cost of training to a maximum government contribution of up to $10,000 per grant; employers must contribute the remaining one‐third. Employers with a plan to train workers for new or better jobs in the Northwest Territories may apply. This includes: Participating employers must have a job available for the trainee upon successful completion of the training. Applicants must be legal entities entitled to operate in the Northwest Territories. |

|

Workplace Innovation and Productivity Skills IncentiveThe Workplace Innovation and Productivity Skills Incentive provides funding for employers and industry associations for training full-time employees to improve productivity and innovation within the organization. It is intended to support new and incremental activity to help businesses compete outside Nova Scotia. Training should help your business move in a new direction or expand your core operations, and promote growth and profitability. |

|

Residential Energy Advisor DiscountsMembers of Efficiency Nova Scotia's Efficiency Trade Network are eligible to:

*Become an Efficiency Trade Network member – it’s free to join! |

|

Canada Nunavut Job Grant (CNJG)The Government of Canada and the Government of Nunavut have agreed to support the training of Nunavummiut for new and better jobs. The Agreement encourages employer involvement in this training so that skill development is better aligned to job opportunities. Eligible employers can receive funding support if they have new or better positions available for trainees and they can make a contribution to the total eligible training costs for each designated trainee. The maximum government contribution to the grant is $10,000 per trainee. The CNJG is designed for small employers (50 or fewer employers) and designated Crown Corporations and Inuit Organizations who wish to target training initiatives for trainees from small remote communities. Employers are eligible for the CNJG if they meet the following criteria. |

|

Canada-Ontario Job GrantOntario signed the Canada-Ontario Job Fund Agreement with the federal government. The agreement is a key source of funding for new initiatives to help Ontario's employers develop their workforce through employer-led training. Employers can get up to $10,000 in government support per person for training costs. Employers with 100 or more employees need to contribute 1/2 of the training costs. Small employers with less than 100 employees need to contribute 1/6 of training costs. The intermediary organization will be paid 15% of the approved COJG ministry contribution to cover the administrative cost related to the completion of the consortium application. |

|

Educational Incentives for Enbridge CustomersThe IESO and Enbridge have collaborated on a joint incentive to support selected training and capacity-building courses available to Enbridge customers across Ontario. With this partnership in place, eligible customers can receive a subsidy for up to 75% combined toward training fees for selected courses. To apply for the Save on Energy incentive, Save on Energy/Union Gas or Save on Energy/Enbridge joint incentives, complete the Save on Energy Training and Support Incentive Application Form and submit with the required documentation to efficiency.training@ieso.ca. |

|

Education and Capacity Building ProgramThe Education and Capacity Building (ECB) Program funds projects that help build the understanding and skills needed for managing and generating energy. This includes activities such as awareness campaigns, material and course development, and education workshops. Version 6.0 of the program includes a possible allocation of up to $100,000 per project. |

|

Save ON EnergySave on Energy provides incentives for a wide range of energy management training. Whether you’re working toward industry-recognized accreditation or looking to build a foundation of energy-efficiency knowledge, Save on Energy Training and Support incentives make it easy to access the most up-to-date training available. Incentives of up to 75% are offered for a range of training courses, including:

To apply for the Save on Energy incentive, Save on Energy/Union Gas or Save on Energy/Enbridge joint incentives, complete the Save on Energy Training and Support Incentive Application Form and submit with the required documentation to efficiency.training@ieso.ca. |

|

Educational Incentives for Union Gas CustomersSave on Energy has partnered with Union Gas to offer a joint incentive on select training for Union Gas customers! For a limited time, eligible customers can receive up to 75% combined of training fees for Dollars to $ense Energy Management Workshops, Building Operator Certification and Certified Energy Manager training from Union Gas and Save on Energy. To apply for the Save on Energy incentive, Save on Energy/Union Gas or Save on Energy/Enbridge joint incentives, complete the Save on Energy Training and Support Incentive Application Form and submit with the required documentation to efficiency.training@ieso.ca. |

|

Canada-Prince Edward Island Job Grant (CPEIJG)Launched in 2014 as a 6-year initiative, this training grant is a segment of the $194M/year Canada Job Grant initiative as part of Canada’s Economic Action Plan. The Canada-Prince Edward Island Job Grant was created to provide training for Canadian employees in order to improve their employability and in-demand skillsets. Non-repayable grant contributions of 66% of training costs (ie. course, exams, textbooks, software resources, etc.) up to a max limit of $10k per trainee. Eligibility: Prince Edward Island-based SME with $2M liability insurance. Trainee must be a resident of Prince Edward Island, permanent Canadian citizen, or granted refugee status. |

|

Workplace Skills TrainingWorkplace Skills Training is a program developed for employers to train new or existing employees to develop their skills and align with needs of the business. The employer determines the type of training and who will participate. Training must be short term and meet job-specific and incremental industry requirements of the organization. Training considered part of the organization's normal business operations will not be eligible under the Workplace Skills Training Program. |

|

Manpower Training MeasureThe training programs you take will help you keep your job and upgrade your skills, or enter the labour market as soon as possible. As a rule, the programs must offer good job prospects in your region. If you need additional training to find a job or keep your current one, the Manpower Training measure can provide financial assistance while you learn, and even reimburse you for your training expenses. Eligibility:

Contact your local employment centre (CLE). An assistance officer will assess your needs and situation and help you determine whether this program is right for you. Find your local employment centre (CLE). |

|

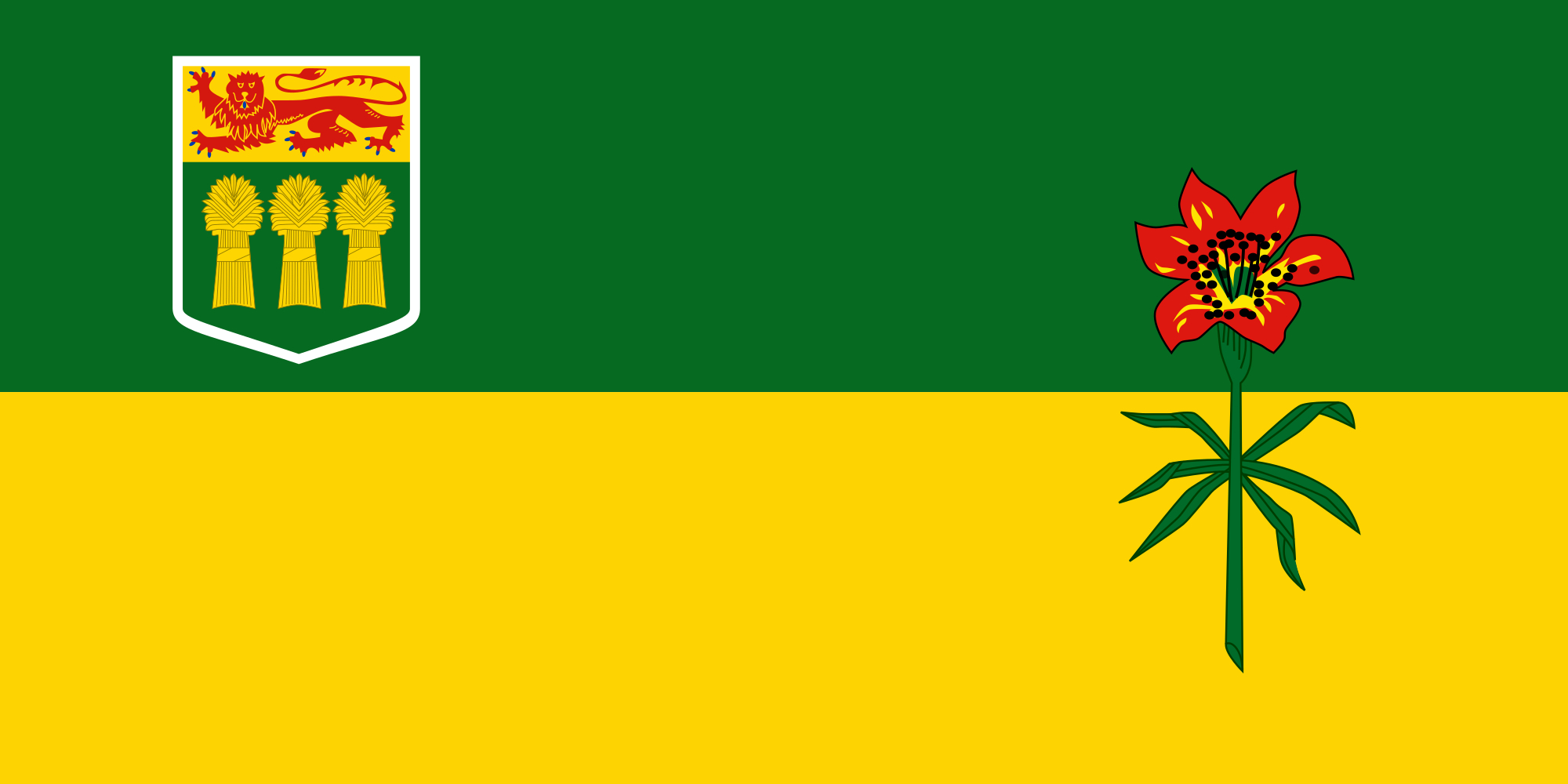

Canada Saskatchewan Job GrantThe Canada-Saskatchewan Job Grant is an employer-driven program that:

Through the program, the employer contributes one-third of the training cost, while the federal and provincial governments contribute the remaining two-thirds. The Canada-Saskatchewan Job Grant is now accepting applications from eligible employers, pending available funding. |

|

SaskPowerCIET registered Energy Advisor training is available at no cost to eligible Saskatchewan residents until March 31st, 2025, or while funding is available. This offer has been made possible by the 100% financial contribution from Natural Resources Canada. |

|

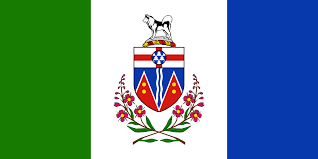

Canada-Yukon Job GrantThe Canada-Yukon Job Grant (CJG) is a program administered by Labour Market Programs and Services, Yukon Education as part of the Canada-Yukon Job Fund. The program is intended to provide employers with funding support to train existing or potential staff for specific, existing or projected positions in the labour market. The government-funded Canada-Yukon Job Grant portion for each training participant will be the lesser of: two-thirds of the actual costs of the training, OR $10,000. Eligible recipients include individual employers and organizations acting on behalf of employers (e.g. employer consortia, union halls, industry associations and training coordinators), in the private and not-for-profit sectors. First Nation Governments and selected crown corporations are also eligible recipients. |

|

Training calendar |

Would you like to be trained on a specific topic? Just let us know!

Express my interestSend us an email and we will respond as soon as possible.

This is to inform you that the course date is too close to be able to ship hard copies of the material to you on time. If you are willing to use the material in secured PDF, receive the material later (likely after the course) and pay upon registration, please click OK to continue the registration process. Please note that the shipping process will start only when the course fees are paid in full and delays are to be expected. Many thanks!